I found a recent article published on Harpers’ online pages to be very interesting and educational, highlighting how the wine industry has a long and complicated relationship with self-sabotage. How many times have I heard, “no one makes money in the wine business” or that it’s simply a “business done for passion, certainly not to make money”? This ingrained perception, however, deeply influences the approach of industry operators, hindering innovation and investment.

If we add to this the chronic pessimistic outlook of producers toward the wine market, it is clear that “non-existent” obstacles are being added to objective problems.

This complex phase of international markets is another eloquent example. For months we have been hearing a Greek lament from many industry operators, starting with the wineries, of course, and then reading data that is certainly not dramatic, such as the first quarter of our export figures, showing a 7% increase in value and a 5.8% increase in volume.

But not even these positive figures change the approach of our system.

Harpers also refers to the old adage, “How do you make a million pounds in the wine business? Start with 2 million and plant a vineyard,” which perfectly sums up the prevailing mentality. This attitude of self-deprecation, however, only serves to reinforce the belief that success in wine is almost impossible, creating a vicious cycle of low expectations and modest results.

However, the facts tell a different story, and some of them are recounted in the Harpers article. Major successes, such as the acquisition of the wholesaler Hallgarten & Novum by Coterie Holdings, or the continuous growth of giants like Berry Bros. & Rudd and Direct Wines, show that there is room for success in the wine world. The British market, for example, is a vibrant mosaic of options for consumers, with bottles, cans, boxes, and kegs from every corner of the world.

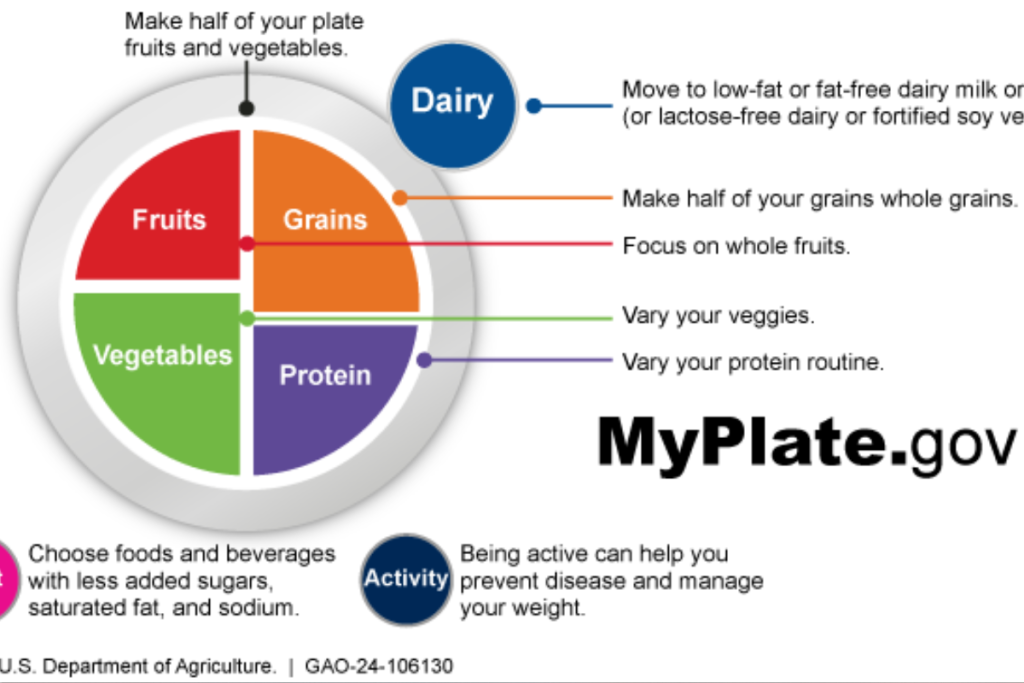

But the key to interpreting the data is also important. For example, despite the March 2024 WSTA market reportshowing a decline in sales volumes for most wine categories, it simultaneously records a slight increase in value. This indicates that consumers are drinking less but drinking better.

The value of the wine and spirits market in the UK, which amounts to £23.7 billion, attests to the economic importance of the sector. However, in the face of pressures such as changes in duties, the sector has united to lobby governments, demonstrating its capacity for cohesion and resilience. This is something to be proud of and should be publicly celebrated, not only among industry insiders but also in the broader community.

Another obstacle is how we communicate about wine. Educators and bloggers, despite their valuable contributions, often work for free, trading their time for press trips, samples, and dinners. This model is not sustainable and undermines the perceived independence of industry experts.

Moreover, the educational approach to wine can be intimidating for new enthusiasts. While we celebrate education with institutions like the WSET and popular films like SOMM, when it comes to communicating with the average consumer, we tend to overwhelm them with technical information and complex terminology. This approach, as we have long denounced, can alienate rather than attract.

Even the language we use can contribute to self-sabotage. Terms like “natural wine” can imply that other wines are less authentic, creating divisions instead of celebrating diversity.

If we focus more on positive stories and less on self-sabotage, we can attract the talent and investment needed to sustain the sector’s growth. People buy from people, and by rebuilding these connections, we can increase the confidence of consumers and investors in our trade. The result will be a market that drinks better, promotes moderation, and continues to invest in the careers we all love.